When it comes to insuring your vehicle, the choice between Tesla Insurance and Geico can be a significant decision.

Both options have their merits and drawbacks, so let’s dive deeper into the details to help you make an informed choice.

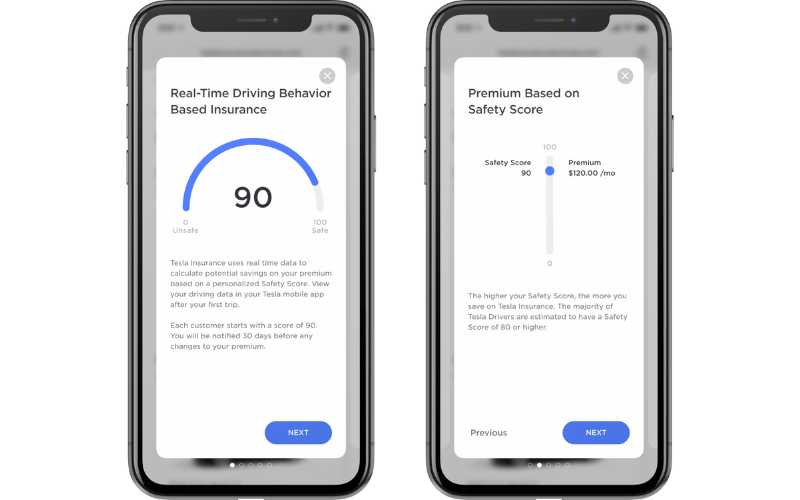

Tesla uses a safety score to determine your insurance rate. The safety score is an automated process that uses real-time data from your Tesla system such as your location, driving, speed, maintenance habits, etc. Geico on the other hand is a traditional insurance provider that relies on the old-school system to determine your insurance rate.

Tesla Insurance

Tesla Insurance is an exclusive insurance offering for Tesla vehicle owners, introduced by Tesla, Inc.

The primary goal behind Tesla Insurance is to create a tailored and seamless insurance experience for Tesla drivers, leveraging the advanced features and data generated by Tesla vehicles.

Pros:

Integration with Tesla Vehicles:

One of the most compelling aspects of Tesla Insurance is its integration with Tesla’s advanced vehicles.

This integration can lead to a more streamlined claims process, potentially quicker repairs through Tesla service centers, and even lower rates for Tesla owners.

Competitive Rates:

Tesla Insurance provides competitive rates, which could be lower than traditional insurance companies. You can insure your Tesla with up to 30% lower premium than Geico if you opt for Tesla insurance.

However, the premium depends on your driving behavior and vehicle model. As explained above, Tesla uses real-time driving safety score that determine how much you would need to pay for the insurance. The higher the safety score, the lower the premium.

Note: I really love this idea. Because you can have instant repercussions for rash or unsafe driving which can act as a deterrent for the future.

These rates can vary based on factors such as vehicle type, driving history, and location, but many Tesla owners report savings.

Comprehensive Coverage:

Tesla Insurance offers coverage that is tailored to the specific needs of Tesla owners, taking into account the advanced safety features and technology found in Tesla vehicles.

One-Stop Shop:

Tesla owners can conveniently bundle their insurance with their vehicle purchase, simplifying the process and potentially reducing paperwork and administrative hassles.

Cons:

Limited Availability:

Tesla Insurance is currently available in a limited number of states, primarily where Tesla operates its own service centers. This can be a significant drawback for Tesla owners in states where it’s not yet offered.

Tesla insurance is currently available in these states-

- Arizona

- Colorado

- Illinois

- Minnesota

- Maryland

- Nevada

- Oregon

- Ohio

- Texas

- Utah

- Virigina

Limited Vehicle Compatibility:

Tesla Insurance is exclusively designed for Tesla vehicles, so if you own a different make or model, you won’t be eligible for coverage.

Geico

Geico, short for the Government Employees Insurance Company, is one of the largest and most well-established auto insurance providers in the United States. It serves a vast customer base across all 50 states.

Pros:

Wide Availability:

Geico’s widespread presence makes it accessible to drivers across the entire United States, providing coverage where many other insurers might not.

Diverse Coverage Options:

Geico offers a broad spectrum of insurance products, including auto, home, renters, and more.

This means you can bundle your auto insurance with other policies, potentially saving on your overall insurance costs.

Discounts and Savings:

Geico provides numerous discounts, such as safe driver discounts, multi-policy discounts, and good student discounts, which can significantly reduce your insurance premiums.

Customer Service:

Geico is renowned for its customer service and has a strong online presence, making it easy for customers to manage their policies, make claims, and access resources.

Cons:

Not Tesla-Specific:

Geico does not offer the same level of integration with Tesla vehicles that Tesla Insurance provides.

If you’re a Tesla owner looking for a seamless experience, you may miss out on this aspect with Geico.

Potentially Higher Rates:

While Geico claims to offer competitive rates, they may not always be the most cost-effective option, especially if you have a unique driving profile or specific insurance needs.

Making the Decision

Choosing between Tesla Insurance and Geico depends on your specific circumstances and priorities. Here are some key factors to consider:

Vehicle Ownership:

If you own a Tesla, the integration and specialized coverage offered by Tesla Insurance could be very appealing. However, if you drive a different make or model, Tesla Insurance is not an option.

I recommend Tesla insurance if all you have is one or multiple Teslas. If you have a diverse range of cars with a mixture of Tesla and others, I would go with Geico. Of course, after getting quotes from multiple insurance companies and comparing them side by side.

Geographic Location:

Check the availability of Tesla Insurance in your state. If it’s not available, Geico becomes a more viable choice.

Insurance Needs:

Consider your specific insurance needs, including coverage limits, deductibles, and additional coverage options. Geico’s wide range of insurance products may offer more flexibility in tailoring a policy to your needs.

Driving History:

Your driving history, including past accidents and violations, can impact your insurance rates. Be sure to get quotes from both providers to compare rates based on your unique situation.

Discounts:

Take advantage of available discounts to lower your premiums. Geico’s range of discounts may be beneficial in this regard.

Looking for more options? We’ve a guide on Tesla Insurance vs AAA.

Ultimately, the “best” insurance provider is the one that offers the right coverage at the most competitive rate for your unique situation.

Remember to compare quotes, read policy details, and weigh the advantages and disadvantages carefully before making your decision.

Your choice should align with your vehicle, location, and individual insurance requirements.