When it comes to insuring your vehicle, you have a multitude of options to choose from.

Two popular choices for car insurance are Tesla Insurance and AAA (American Automobile Association).

Both offer different features and benefits, and deciding which one is best for you can be a daunting task.

In this article, we’ll compare Tesla Insurance and AAA across various key factors to help you make an informed decision.

Tesla vs AAA

Let’s compare Tesla and AAA head-to-head to pick the perfect option for you.

| Aspect | Tesla Insurance | AAA |

|---|---|---|

| Premium Rate | Rates fluctuate depending on your real time safety score. Rash driving increases cost. | Rates influenced by factors like location, driving record, and chosen coverage. Discounts are available for members. |

| Coverage in USA | Only available in 11 of 50 states. | Available in all 50 states. |

| Customer Service | Relatively new entrant with mixed customer feedback. Convenience of dealing directly with Tesla. | Established reputation for good customer service. Local offices and agents for in-person assistance. |

| Repair and Claims | Streamlined process with a network of Tesla-authorized repair shops. Priority for genuine Tesla parts. | Availability of genuine Tesla parts may vary. Repair quality and times depend on the repair facility. |

| Discounts | Incentives for using Tesla safety features and Autopilot. Discounts for bundling with Tesla’s Full Self-Driving package. | Offers various discounts, including safe driver, multi-vehicle, and bundling discounts. |

| Additional Services | Tailored to Tesla owners’ needs. May provide advantages beyond insurance coverage. | Offers a wide range of services beyond auto insurance, such as roadside assistance and travel planning. |

Which One Has Better Coverage Options?

Tesla Insurance:

Tesla Insurance is designed specifically for Tesla owners. It offers coverage options that cater to the unique features and technology found in Tesla vehicles.

This includes coverage for Autopilot and Full Self-Driving (FSD) features, as well as Tesla-specific repair options.

AAA:

AAA offers a wide range of coverage options for all types of vehicles, not just Tesla cars.

They provide standard coverage, including liability, collision, and comprehensive coverage, which can be customized to your needs.

AAA also offers specialized coverage for classic and collector cars.

Is Tesla Cheaper than AAA?

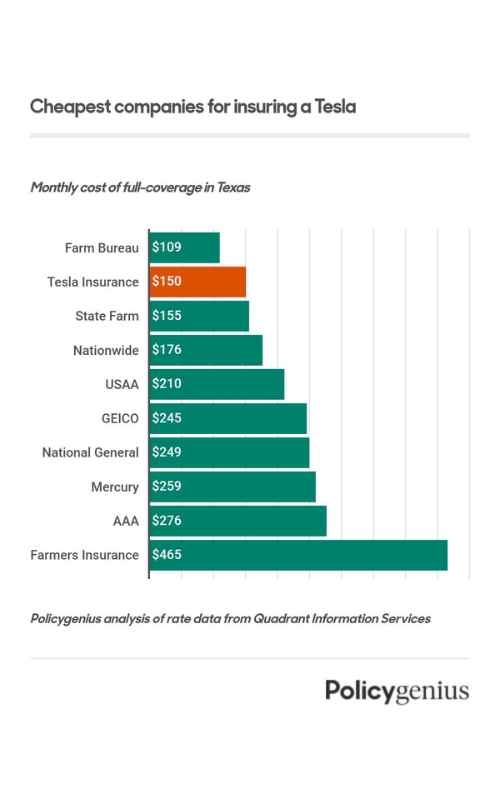

Tesla Insurance claims to offer competitive rates for Tesla owners due to their deep understanding of the vehicles’ technology and safety features. If compared apple to apple, Tesla Insurance saves you around 20 to 30% cost on Insurance compared to AAA and other providers.

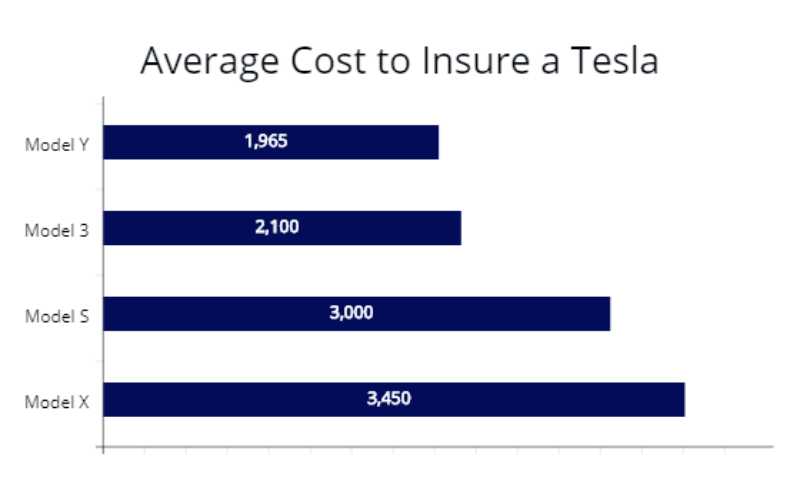

However, the cost can vary depending on factors such as your location, driving history, and the specific Tesla model you own.

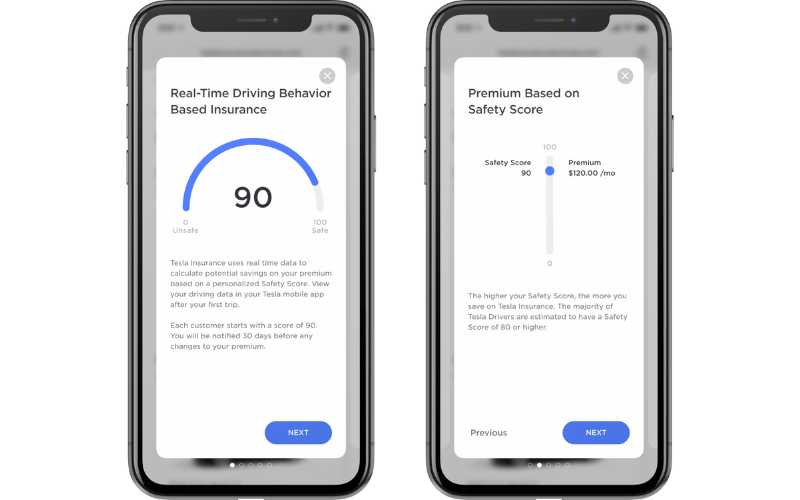

Tesla uses a safety score to determine your premium at the end of the month. The safety score is given in real life by considering your vehicle, the safety of your neighborhood, your driving pattern, etc.

AAA’s rates may be also influenced by various factors, including your location, driving record, and the type of coverage you select. But they do not consider any real-time data as they don’t have access to your vehicle system!

They offer discounts to members and bundling options for those who also purchase other AAA services. So, if you are not going all-electric, AAA insurance might be suitable for you considering you getting hefty discounts of up to 20-25% on premiums on multiple cars.

I recommend talking to both Insurance providers along with some other prominent ones and see what each of them quotes. Then compare all those in a table to decide the best possible solution.

Customer Service

Tesla Insurance is a relatively new player in the insurance market, and as such, there is limited data on its customer service.

Tesla owners report mixed experiences, with some praising the convenience of dealing directly with Tesla, while others express concerns about communication and claims handling.

AAA has a long history and a well-established reputation for providing good customer service.

They have local offices and agents in many areas, which can be convenient for in-person assistance.

AAA members often value the peace of mind that comes with their well-known brand.

Repairability

Tesla Insurance may offer a smoother repair and claims process for Tesla owners.

They have a network of Tesla-authorized repair shops and may prioritize genuine Tesla parts for repairs.

This can potentially lead to quicker repairs and a more streamlined process for Tesla owners.

On the other hand, AAA provides coverage for a wide range of vehicle makes and models. While they have their own network of approved repair shops, the availability of genuine Tesla parts may vary.

Repair times and quality could depend on the specific repair facility and the parts available.

Claims Process

Both Tesla and AAA have a pretty smooth claiming process. You can file insurance claims through the mobile app of Tesla while AAA allows you to file claims by phone, online, or in a branch.

So, both are pretty well balanced in this aspect.

Final Verdict

Choosing between Tesla Insurance and AAA ultimately depends on your specific needs and preferences.

If you own a Tesla and value insurance coverage that is tailored to your vehicle’s unique features, Tesla Insurance may be a compelling option. On the other hand, if you want more flexibility, a wider range of coverage options, and a well-established customer service reputation, AAA could be the better choice.

Before making a decision, it’s essential to obtain quotes from both insurers, compare coverage options, and consider your individual circumstances. Want to compare more options? Check Tesla Insurance vs Geico.

Additionally, reading reviews and seeking recommendations from other Tesla owners or AAA members can provide valuable insights into the customer experience.

Ultimately, the best insurance choice for you will depend on your priorities and the level of coverage and service you require for your vehicle.